In today’s fast-paced world, financial stability and security are more critical than ever. For Malaysians, navigating the complexities of personal finance can be daunting, but with the right guidance, anyone can build a secure financial future. This article aims to shed light on the importance of financial planning and how it can transform your life.

Understanding Financial Planning

Financial planning is a comprehensive approach to managing your money to achieve your life goals. It involves analyzing your current financial situation, setting realistic goals, and creating a roadmap to reach those goals. This process includes budgeting, saving, investing, protecting your wealth through insurance, and planning your estate.

Key Components of Financial Planning

- Budgeting: Keeping track of your income and expenses helps you understand where your money goes and how you can allocate it better.

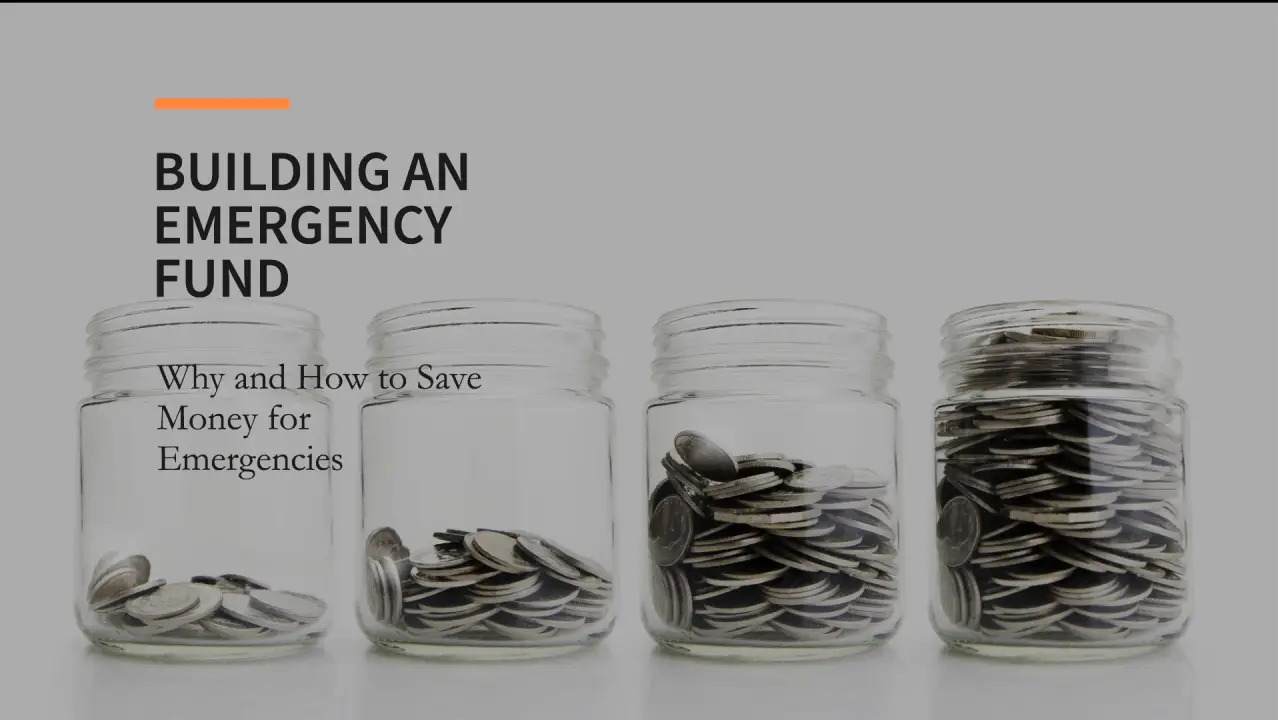

- Saving: Building an emergency fund and saving for future goals, like buying a house or retirement, ensures you’re prepared for unexpected expenses.

- Investing: Growing your wealth through investments can help you achieve long-term financial goals.

- Insurance: Protecting yourself and your family against unforeseen events is a critical aspect of financial planning.

- Retirement Planning: Ensuring you have enough saved and invested for a comfortable retirement is essential for long-term security.

- Estate Planning: Planning for the distribution of your assets after your death ensures that your wishes are honored and your loved ones are taken care of.

Why Financial Planning is Important for Malaysians

1. Achieving Financial Independence

Financial independence means having enough resources to live comfortably without relying on others. With a proper financial plan, you can achieve this independence, ensuring you can maintain your lifestyle even in times of economic uncertainty.

2. Preparing for Life’s Uncertainties

Life is full of unexpected events, from medical emergencies to sudden job loss. A solid financial plan helps you prepare for these uncertainties, ensuring you have a safety net to fall back on when times get tough.

3. Making Informed Decisions

Financial planning involves understanding your financial situation and making informed decisions about your money. This knowledge empowers you to take control of your finances and make choices that align with your goals.

4. Maximizing Your Wealth

Through smart investments and careful planning, you can maximize your wealth over time. This not only helps you achieve your financial goals but also allows you to enjoy a better quality of life.

5. Ensuring a Comfortable Retirement

In Malaysia, the government provides some support for retirees, but it might not be enough to maintain your desired lifestyle. Planning for retirement ensures you have enough savings and investments to enjoy your golden years without financial stress.

6. Protecting Your Legacy

Estate planning ensures that your assets are distributed according to your wishes after your death. This can prevent legal complications and ensure that your loved ones are taken care of.

Steps to Start Your Financial Planning Journey

1. Assess Your Current Financial Situation

Begin by evaluating your income, expenses, debts, and savings. Understanding where you stand financially is the first step toward creating an effective plan.

2. Set Realistic Goals

Identify what you want to achieve with your money. Whether it’s buying a home, starting a business, or retiring early, setting clear, realistic goals is crucial.

3. Create a Budget

A budget helps you manage your money more effectively. Track your income and expenses to ensure you’re living within your means and saving for your goals.

4. Start Saving and Investing

Open a savings account and start putting money aside regularly. Explore investment options that suit your risk tolerance and time horizon to grow your wealth.

5. Get Insured

Ensure you have adequate insurance coverage for health, life, and property. This protection is vital to safeguard your financial future.

6. Plan Your Estate

Create a will or trust to outline how your assets should be distributed after your death. This step can prevent disputes and ensure that your wishes are carried out.

7. Seek Professional Advice

A licensed financial planner can provide expert guidance tailored to your specific needs. They can help you create a comprehensive financial plan and adjust it as your circumstances change.

Conclusion

Financial planning is not just for the wealthy; it’s for everyone who wants to achieve financial stability and security. By understanding its importance and taking proactive steps, Malaysians can navigate their financial futures with confidence and peace of mind. Start your financial planning journey today, and take control of your financial destiny.

Disclaimer: This article reflects my personal views and experiences as a Licensed Financial Planner. It does not represent the opinions or positions of any company or third party.